If you’ve never experienced disputes over money with family members, consider yourself lucky. Clashes over financial matters are the fifth most popular reason why conflicts between family members happen, according to one British poll. More often than not, those matters involve an inheritance.

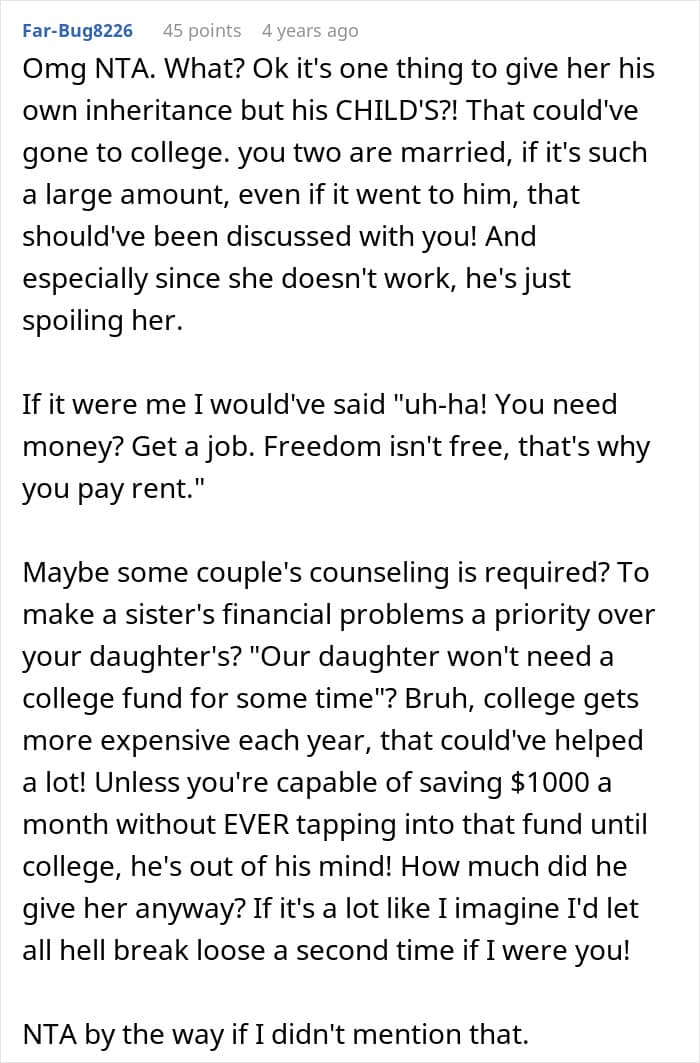

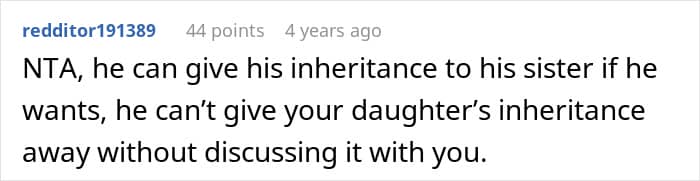

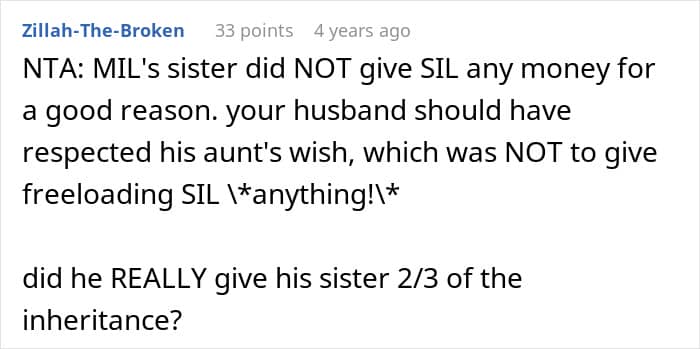

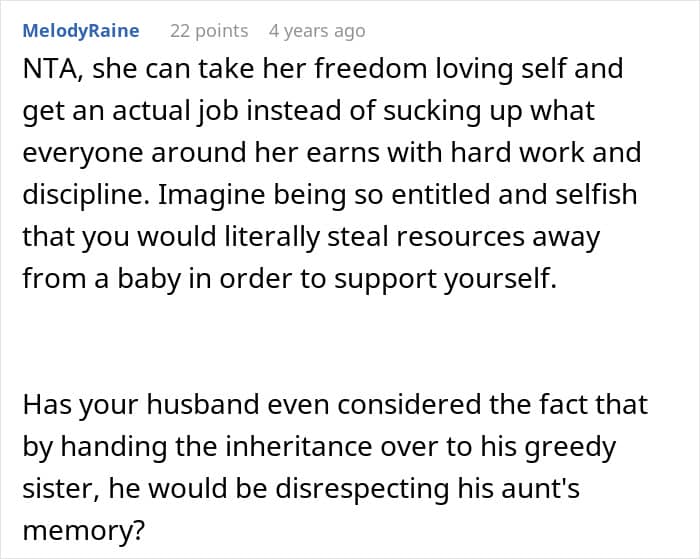

For one young family, a deceased aunt’s will became the source of conflict. The lady left part of her inheritance to her nephew and his little daughter. However, her troubled niece also felt entitled to a share of the inheritance. The brother caved in and decided to share out of pity, but did so unbeknownst to his wife.

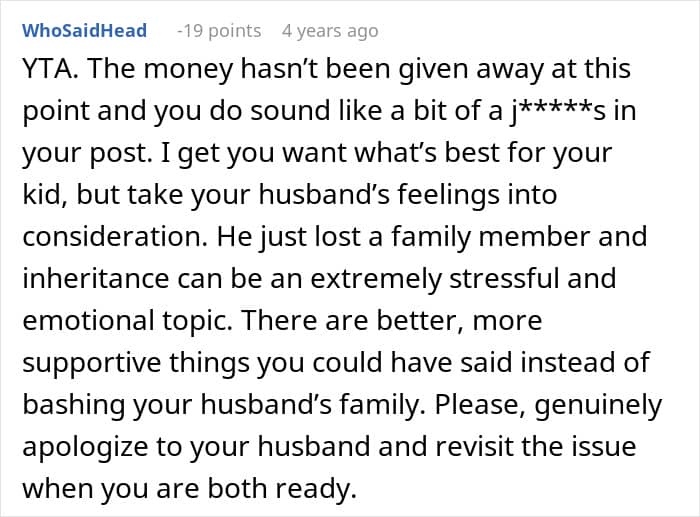

RELATED:A husband angered his wife by sharing his and his daughter’s share of his aunt’s inheritance with his sister

According to the woman, the sister didn’t deserve it and that wasn’t the late aunt’s wish anyway

People may choose to leave out relatives from their will, but should let them know about it in advance

It’s not unusual for people to feel disregarded and hurt after being disinherited by a family member. While it’s hard to say exactly how many conflicts inheritances cause among family members, the percentage of contested wills is not very high in the U.S. – only somewhere around 3%.

Still, just because they’re not taking legal action, doesn’t mean that the disinherited family members are happy about it. Interestingly, people don’t see the issue with allocating different amounts to family members in their wills. According to a survey by a UK-based law firm Moore Barlow, almost half of older Brits say it’s fair to leave relatives different sums of money.

While there’s nothing wrong with leaving certain family members out of the will, it’s quite mean to do so without letting them know beforehand. “Leaving different amounts to children or grandchildren, or prioritising charities, often makes sense based on personal circumstances or values,” Scott Taylor from Moore Barlow explained.

“But these decisions can easily lead to confusion or anger if not communicated clearly. Open and honest conversations with loved ones are key to ensuring your wishes are understood and respected, and can help prevent potential fallouts after you’re gone.”

Another survey by Irwin Mitchell shows that only a small percentage of people are discussing their inheritance with family members. Among Brits over the age of 55, less than a third have talked about their wills with their children.

These are some of the reasons why people choose to disinherit their family members

Families are complicated, and conflicts are often reflected in the wills of deceased family members. Legal experts generally cite six reasons that might drive someone to disinherit a family member from their will.

Estrangement. According to one poll, 27% of Americans are estranged from their parents. Some relatives just don’t have a close relationship. In that case, naming them in your will may seem nonsensical; you pick the family members you keep in touch with.They’re irresponsible or troubled. Some adult children, nephews, and nieces may be bad at managing their finances. In other cases, addiction can be a factor, too. The testator (the one whose will it is) may be concerned about how the benefactor will use the inheritance. In these cases, setting up a trust might be a good idea. It would specify how and when the inheritance can be used.Divorce or remarriage. In blended families, inheritances become even more complicated. When there are two sets of adult children, the testator might prioritize their immediate family and nieces and nephews might simply be left out. Similarly, adult children from first marriages sometimes get disinherited because of second marriages, too.They’re already well-off. Sometimes, relatives who are already financially set don’t receive any share of the inheritance since other family members might need it more. This also applies to potential benefactors with disabilities who already receive benefits.They’ve already been given a portion of the deceased’s estate. In some cases, parents, grandparents, aunts, and uncles may choose to gift money or assets to relatives while they’re still alive. In that case, they choose to disinherit them from future inheritance since they may feel that giving them even more would be unfair.Choosing to give away estate to charity. Some people choose to disinherit all family members and give away their money to charitable causes. Bill Gates, for example, chose to give 99% of his considerable wealth to charity.

Usually, testators are allowed to disinherit family members if they wish to. However, in some countries and states, spouses and children can be entitled to a portion of an inheritance even if they were not included. But, as far as extended family (like nieces and nephews) goes, contesting a will might not be as successful.

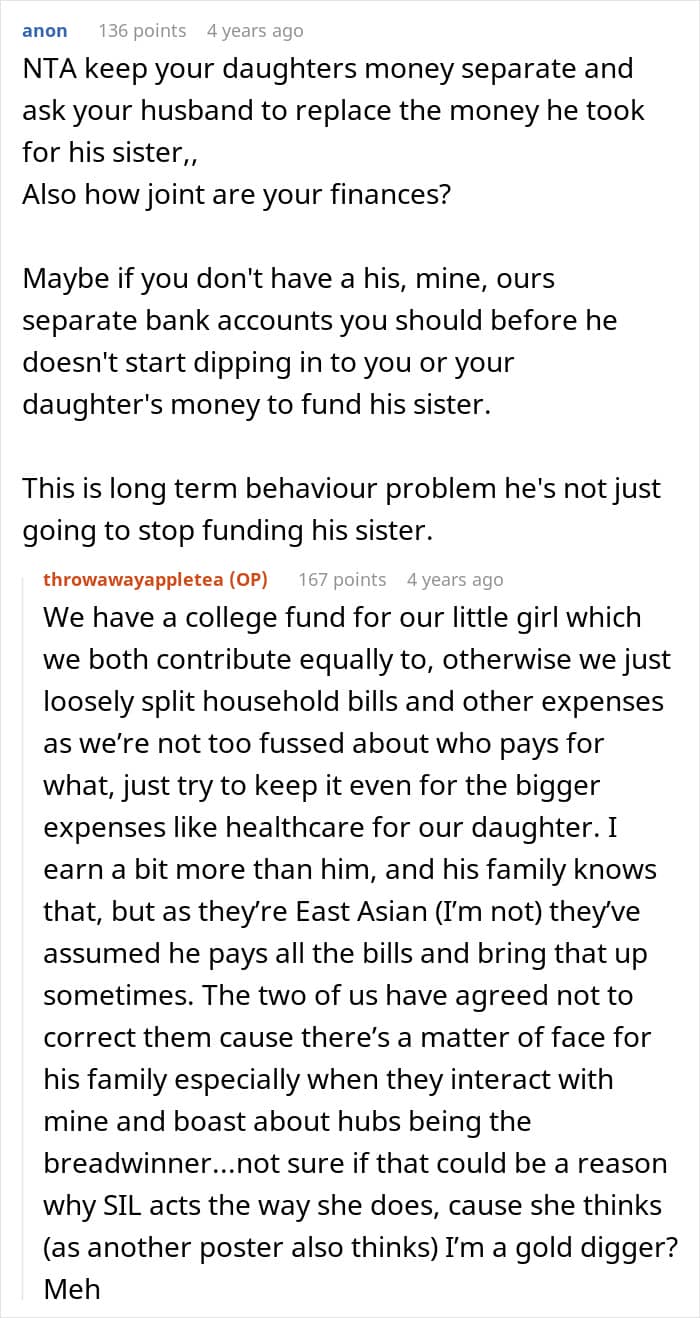

Usually, the couple doesn’t have disagreements about finances, as the woman explained in a comment

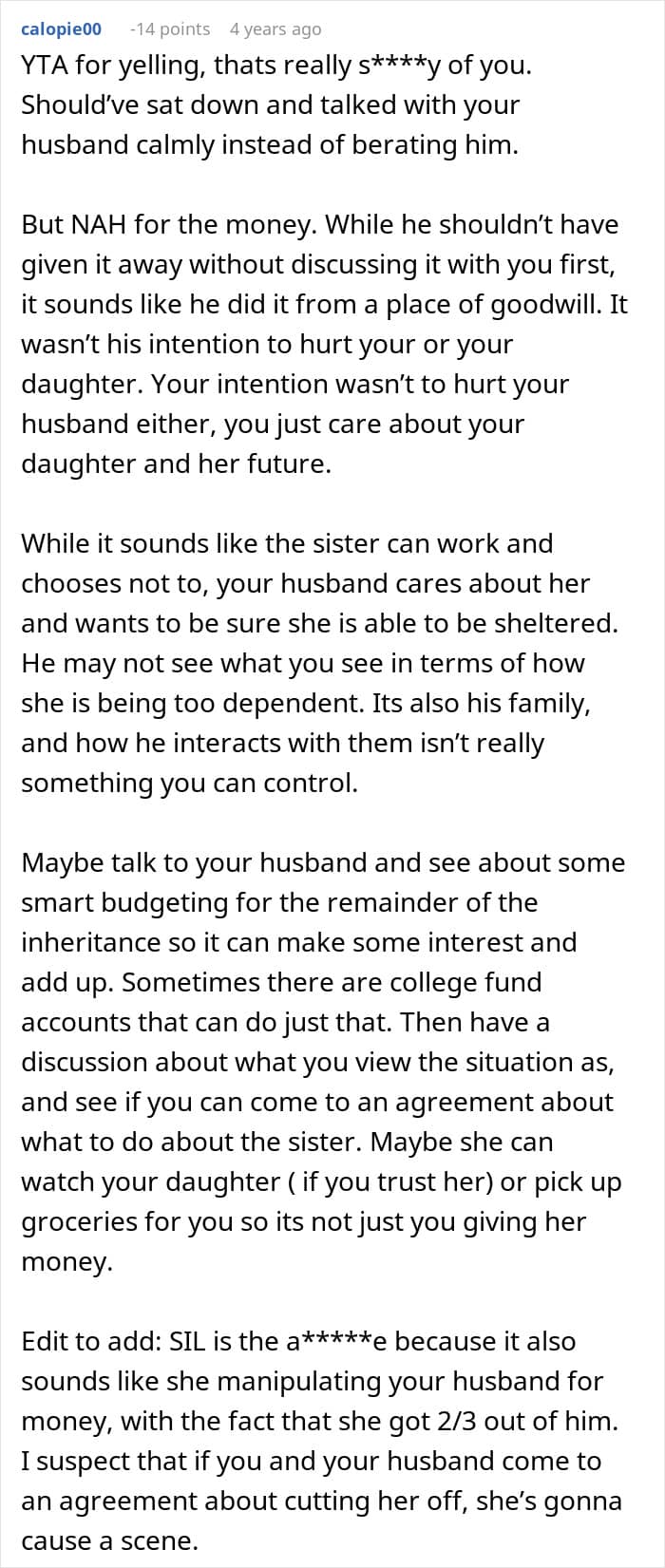

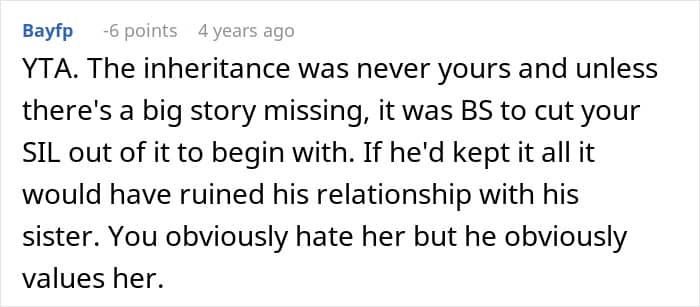

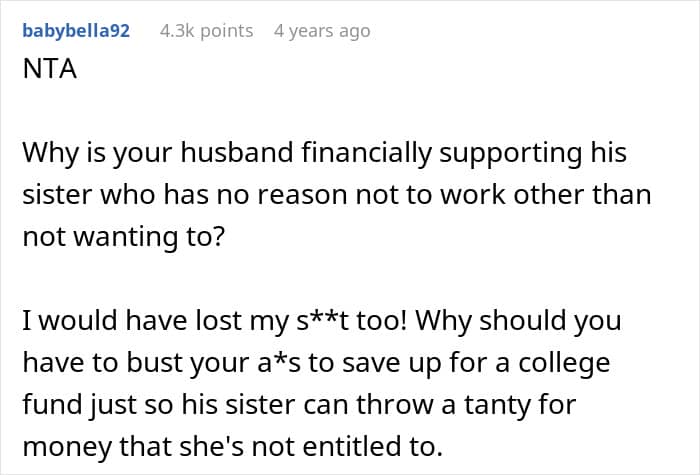

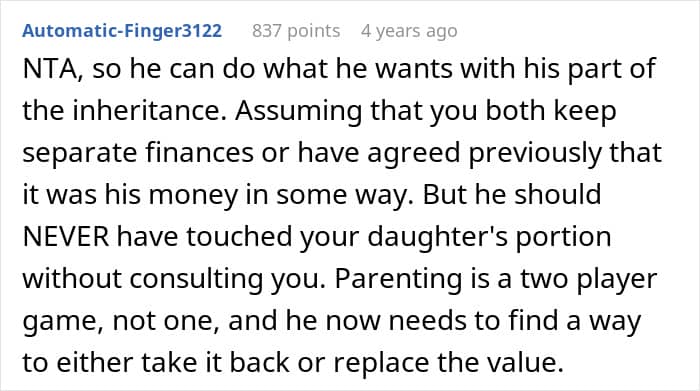

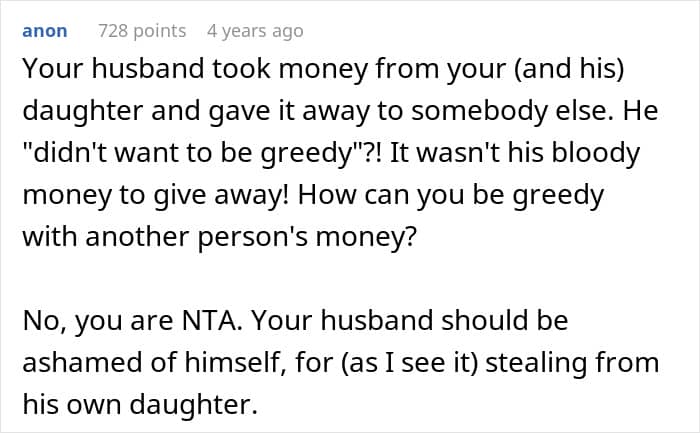

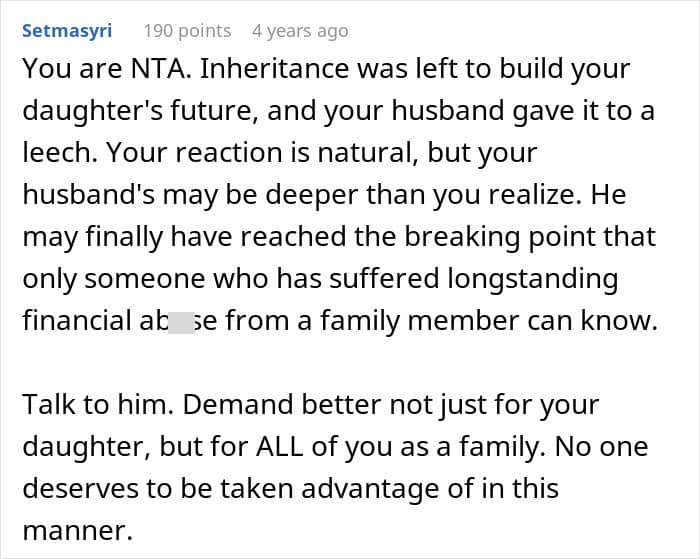

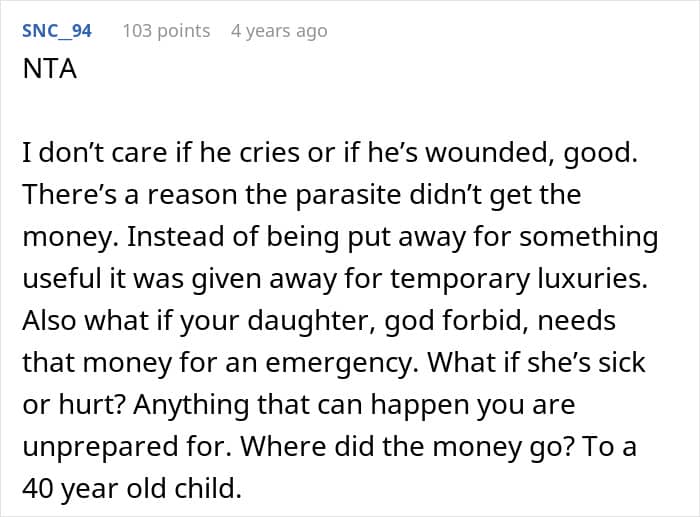

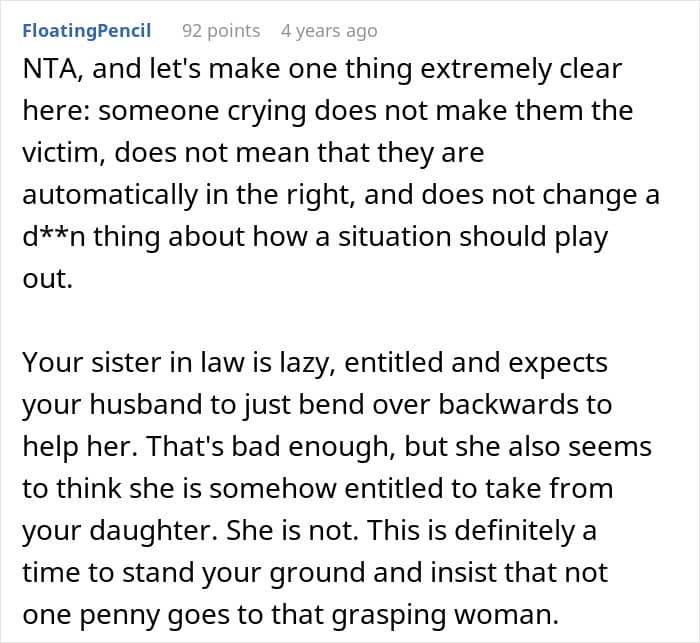

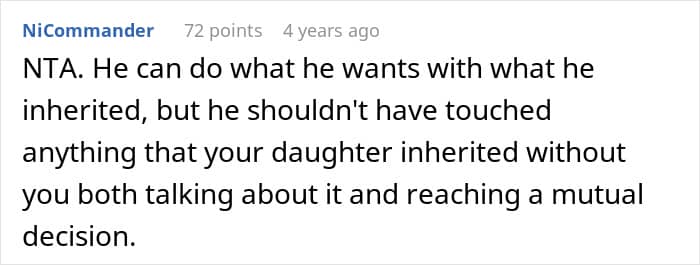

Commenters sided with the woman, saying that the husband shouldn’t have done that without consulting his wife

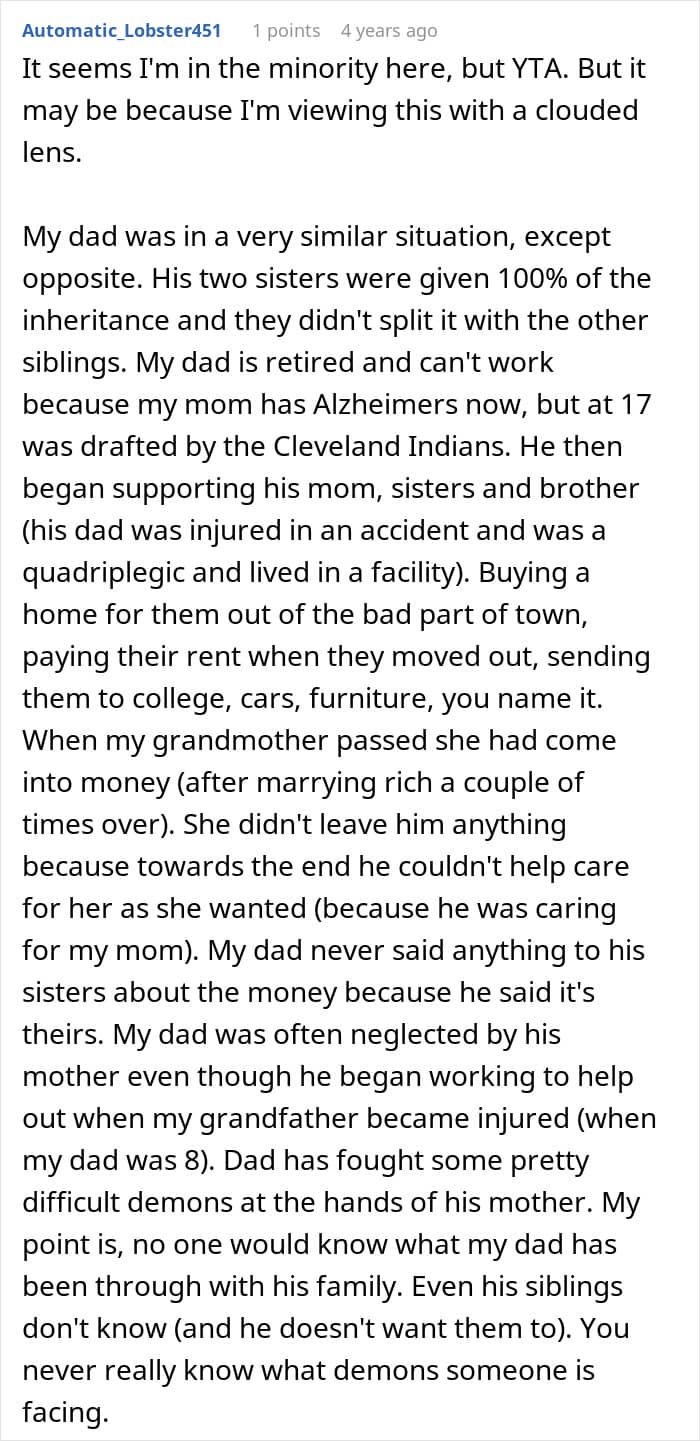

However, others thought the wife was too judgmental towards the sister: “You never really know what demons someone is facing”